Gold Silver Prices Firmer as Traders Buy the Dips

Red Maple FX offers both non discretionary trading accounts and fully managed trading accounts. Call Toll Free + 1 888 673 2812

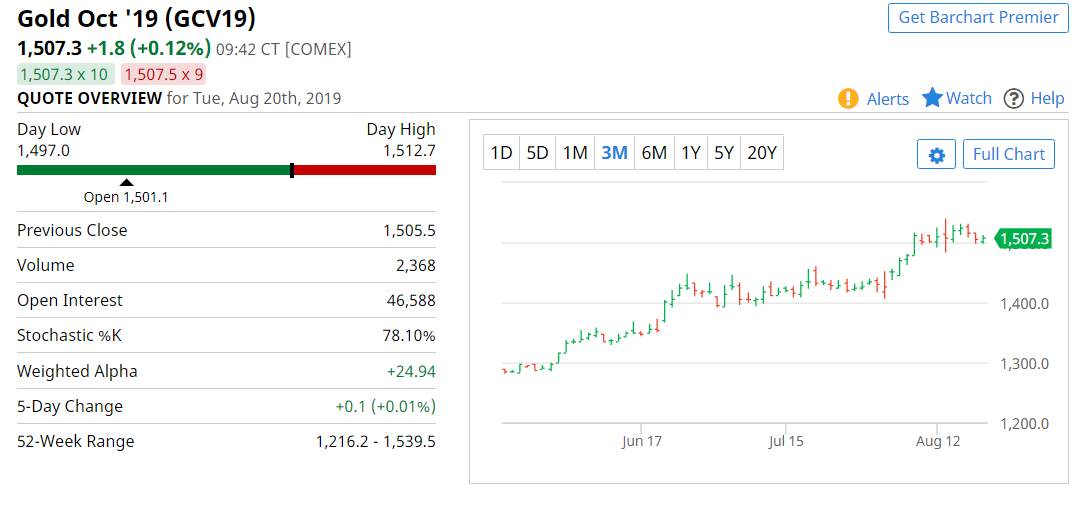

Gold and silver prices are modestly up in early U.S. trading Tuesday, as Monday’s price weakness is reckoned to be a buying opportunity in markets that remain in solid uptrends and not far below their recent highs. More upbeat trader and investor attitudes early this week are limited the upside in the safe-haven metals, however. December gold futures were last up $2.70 an ounce at 1,514.20. September Comex silver prices were last up $0.04 at $16.98 an ounce.

Global stock markets were steady to firmer in overnight trading. U.S. stock indexes are pointed toward slightly higher openings when the New York day session begins.

While trader and investor sentiment remains more positive Tuesday, is this just a reprieve before the keener uncertainty and anxiety returns to the world marketplace? Slowing world economic growth, geopolitics that sees some hotspots and worrisomely low global inflation are all still lingering, heading into what can be turbulent trading months of September and October. My bet is that the world markets still have some rough waters and higher volatility just ahead.

President Trump continues his assault on the Federal Reserve, on Monday saying the central bank has shown a horrendous lack of vision. Later this week the annual Jackson Hole, Wyoming Federal Reserve confab that sees central bankers of the world attending will be extra closely monitored by the marketplace. Fed Chairman Powell speaks to the gathering Friday.

The German government today set a zero percent coupon on its new issue of 2050-dated bonds (bunds). Just a few years ago veteran market watchers would have shuddered to think that an investor would be interested in a 30-year bond that pays no interest.

The key outside markets today see Nymex crude oil prices near steady and trading around $56.25 a barrel. The U.S. dollar index is slightly higher.

U.S. economic data due for release Tuesday is light and includes the weekly Johnson Redbook and Goldman Sachs retail sales reports. The pace picks up Wednesday with the release of the minutes of the last FOMC meeting.

Technically, the gold bulls have the solid overall near-term technical advantage. A 2.5-month-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close in October futures above solid resistance at the August high of $1,546.10. Bears' next near-term downside price breakout objective is pushing December futures prices below solid technical support at $1,488.90. First resistance is seen at today’s high of $1,518.80 and then at Monday’s high of $1,523.60. First support is seen at the overnight low of $1,503.00 and then at $1,500.00. Wyckoff's Market Rating: 7.5

September silver futures bulls have the solid overall near-term technical advantage. Prices are in a 2.5-month-old uptrend on the daily bar chart. Silver bulls' next upside price breakout objective is closing prices above solid technical resistance at the August high of $17.49 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at $16.51. First resistance is seen at Monday’s high of $17.175 and then at $17.25. Next support is seen at Monday’s low of $16.82 and then at $16.685. Wyckoff's Market Rating: 7.5.

An offshore commodities and forex trading firm, Red Maple Trading offers a combination of first-class trading advice and an award winning portfolio management team with an exemplary trading record.

Red Maple FX offers both non discretionary trading accounts and fully managed trading accounts. Call Toll Free + 1 888 673 2812